Properties of a cryptocurrency

Trustless and permissionless

What is needed is an electronic payment system based on cryptographic proof instead of trust, allowing any two willing parties to transact directly with each other without the need for a trusted third-party.

These are the most important properties of cryptocurrencies as I see it:

- No more third parties

- No counterfeiting

- Irreversible transactions

- Predetermined emission rate

- Private

- Large and small amounts behave the same

- Borderless

They highlight the difference between cryptocurrencies and other payment systems and are ultimately what makes cryptocurrencies useful.

No more third parties

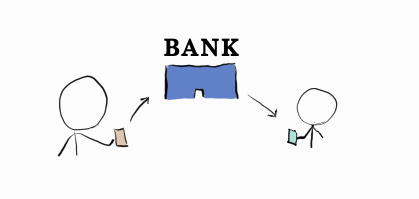

The important difference between a cryptocurrency and the digital payments we have today is the removal of a third-party. Payments are peer-to-peer just as if you gave someone a dollar bill or a gold coin.

Sending money to people via your bank isn’t peer-to-peer as you rely on your bank to send it for you. VISA, PayPal, Swish, Apple Pay, and other digital payments have the same problem, all except cryptocurrencies.

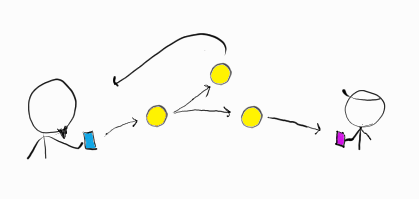

Transfers are therefore trustless and permissionless.

Trustless means you don’t have to rely on a third-party to make or confirm the transfer for you, and permissionless means you don’t have to worry about your transactions being blocked. Nobody can freeze your account or prevent you from opening one. Cryptocurrencies are uncensorable.

You also don’t have to trust a third-party to hold your money like you do when you have money in a bank.1 What you really have is an IOU from the bank where they promise to give you your money when you ask for it. With cryptocurrencies, you can write down the keys to your wallet and you, alone, have access to it.2

No counterfeiting

Problems with counterfeit coins and bills go far back. From biting coins to test their hardness to today’s advanced techniques, counterfeit prevention has always been an important feature for cash.

With cryptocurrencies, anyone can independently verify the integrity of the coins you send and receive. Details on how is in the next chapter but I assure you no biting is needed. You cannot counterfeit coins and you cannot send the same coin to multiple people (double-spend). This is what allows cryptocurrencies to operate without a trusted third-party.

Irreversible transactions

Just like with cash, cryptocurrency transfers are irreversible. This means if you’ve sent someone coins, you can only get them back if they agree to give them back. It prevents charge back fraud but it makes theft worse.

Predetermined emission rate

As there’s no trusted third-party, there’s no single entity who controls the creation of new money and the inflation. Instead, new coins are minted following predetermined rules.

If inflation is good or bad depends on who you ask. Keynesian economists argue inflation is good while the Austrian school argues inflation is bad.

I definitely don’t know who is right. It’s probably best to be skeptical of both camps—economics operate in an extremely complex and irregular environment. Economic theories are difficult, or impossible, to verify.

acquisition of skills requires a regular environment, an adequate opportunity to practice, and rapid and unequivocal feedback about the correctness of thoughts and actions.

Either way, it’s not an argument against cryptocurrencies in general, as they can be made either inflationary or deflationary (although, all I know of becomes deflationary).

Private

Commonly used payment systems, like credit cards for example, asks you to give up your privacy as all payments are recorded. So they require you to tie your identity to them. But cryptocurrencies can be used privately—there’s no need to disclose your identity or your transaction history—making them similar to cash in this respect.

Large and small amounts behave the same

In contrast to cash or gold where large amounts can be cumbersome to handle, there’s no difference between large or small transfers in a cryptocurrency. Transaction costs are the same for small transfers as for large transfers. They are just as secure and wallets can store as much as you’re comfortable with.

It’s also easy to split coins into small parts. In fact, you don’t have to think about dividing at all, you use a wallet just like a credit card—a transfer is always exact.

Borderless

Cryptocurrencies are inherently global. They’re usable wherever you are as long as you have an internet connection. You can even send to wallets that are offline, but to retrieve them you need to access the internet. Technically, you could do transfers completely offline—on paper—but they would be unconfirmed and might not be valid when you do want to use them.